Amid the Ukraine-Russia war, rising interest rates, mass layoffs, high inflation, and rising global recession fears, 2022 saw the stock market have its own share of highs and lows amid volatility and economic uncertainty.

While many investors might have panicked, a few stuck to their investment strategies. Even the banking crisis that struck in the early months of 2023 could do little to impact the wealth or portfolio of large individual investors in Indian stock markets.

Jump To

![]()

Portfolios of India’s Super Rich Stock Market Investors

A Forbes India analysis of India’s super rich’s portfolio in the three months ending March 2023, i.e., January–March 2023, based on data provided by Prime Database, revealed that these masters-of-the-game held on to their equity in companies even as overall markets tanked in the period. The analysis is based on shareholding patterns filed by 1,838 of the total 1,864 companies listed on the NSE (main board) for the quarter ending March 31, 2023.

It includes portfolios of individual investors whose combined holding across multiple companies is more than Rs 250 crore as of March 2023 and may include promoters as part of public shareholdings in a few cases.

Which Indian Has The Biggest Investment Portfolio?

businesstoday

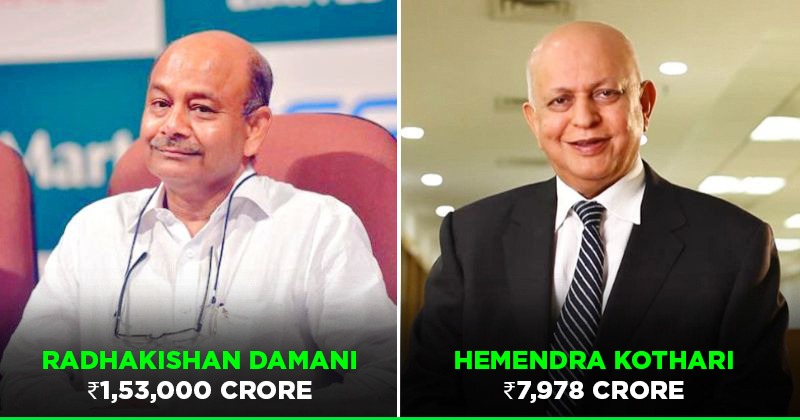

As per the Forbes report, topping the chart is Radhakishan Damani, promoter of Avenue Supermarts, which runs and operates retail format stores like D-Mart. At the end of March, Damani’s cumulative holdings were worth Rs 1.53 trillion (Rs 1,53,000 crore). However, over the last quarter, it has declined 16.14 percent from Rs1.83 trillion in the October-December period. In percentage terms, his top holdings were Avenue Supermarts—where he cut exposure to 67.51 percent from 67.53 percent—the share price of which fell 16 percent during the three-month period. His other top holdings were VST Industries, India Cements, Trent, and Sundaram Finance.

In value terms, Damani has raised his stake in 3M India, Trent and Aptech. The share prices of those stocks climbed 1-5 percent in the period.

Late Rakesh Jhunjhunwala Comes Second

fortuneindia

Next, with a wide margin gap when compared to first placed Damani, is the late Rakesh Jhunjhunwala, whose cumulative holding was Rs 32,296 crore in March, falling by 3.61 percent from Rs 3,506 crore in December. Jhunjhunwala invested in stocks through entities like Aryaman Jhunjhunwala Discretionary Trust, Aryavir Jhunjhunwala Discretionary Trust, Nishtha Jhunjhunwala Discretionary Trust, Rare Enterprises, Rare Equity Pvt.Ltd, Rajeshkumar Radheshyam Jhunjhunwala and his wife Rekha Rakesh Jhunjhunwala.

Rakesh Jhunjhunwala’s love for the Titan stock has been no secret, as his stake was raised to 5.29 percent in March (from 5.17 percent). His holding in Sun Pharma Advanced Research also climbed to 1.94 percent, which was below 1 percent in the quarter-ago period. Jhunjhunwala has the highest exposure to Aptech, Star Health and Allied Insurance Company, Metro Brands, NCC, and Rallis India, as mentioned in the report.

The top five companies in which Jhunjhunwala reduced his stake (by percentage terms) are Dishman Carbon Amcis, Autoline Industries, Edelweiss Financial Services, DB Realty, and Nazara Technologies. Except for Dishman Carbon Amcis, whose stock price jumped 31 percent, other four fell 10–31 percent in the three-month period.

Also Read: Rakesh Jhunjhunwala’s Stock Prediction For Zomato Comes True

Hemendra Kothari Holds Third Biggest Investment Portfolio

ET

Third ranked is maverick investor Hemendra Kothari, whose cumulative holding was Rs 7,978 crore, a fall of 13.73 percent from preceding three months. Kothari’s reported investment entities include Aditi Hemendra Kothari Desai, Anjali Yogesh Kothari, Nini Yogesh Kothari, Shuchi Hemendra Kothari, Suneet Yogesh Kothari and Yogesh Mathradas Kothari.

His top five favourite stocks in the portfolio are Alkyl Amines Chemicals, Sonata Software, Veranda Learning Solutions and EIH Associated Hotels.

Some ‘Not So Popular’ Rich Investors

The analysis as per Forbes report shows that there are 27 large individual investors whose cumulative holdings were over Rs 250 crore at the end of March 2023, despite a downturn in markets. We throw some light on portfolio of UHNIs who are not so popular.

Anuj Anantrai Sheth, promoter of Anvil Share & Stock Broking Pvt, with cumulative holding of Rs1,139 crore has seen a decrease by 11.04 percent in a quarter. His top stocks are Themis Medicare, Bannari Amman Spinning Mills, Bannari Amman Sugars, Finolex Industries and Asahi India Glass.

Investor Tejas Trivedi’s cumulative holding is Rs1,132 crore, which fell by 8.46 percent in three months. His top bets are AstraZeneca Pharma, Centum Electronics, NOCIL, Atul and Asia Hyper Retail, the report mentoned.

Sachin Bansal’s cumulative holding as on quarter ending March 2023 was Rs 523 crore (also including Anandam Enterprises, Navodya Enterprises, SPV Enterprises, SPV Traders, Parveen Kumar Bansal, Seema Bansal and Vivek Bansal). Over the last quarter (since December 2022), this has decreased by 19.12 percent from Rs 647 crore.

Akash Bhanshali is placed at fourth position in the Forbes list, with a cumulative holding of Rs 3,616 crore (fell by 4 percent QoQ). He is the son of veteran investor Vallabh Bhansali’s late brother and Enam co-founder Manek Bhanshali.

Also Read: How Investing In Stocks Differs From Mutual Funds

How Indian Stock Market Performed In The Same Period

PTI

Indian stock markets, in tandem with its global peers, were in a tough situation in the January to March quarter. Benchmark indices Sensex and Nifty had declined nearly 3-4 percent while smaller stocks had taken a heavy beating, as per the report. Foreign institutional investors (FIIs) were heavy sellers of Indian stocks in the three months: They sold shares worth Rs35,048 crore from oil, gas & consumable fuels, and financial services sectors during the quarter while investing Rs12,994 crore in the services and capital goods sectors. Domestic institutional investors (DIIs) were net buyers of stocks worth Rs 83,200 crore in January to March.

However, as far as May 2023 is concerned, foreign investors had pumped in a mammoth money in first few days itself.

For the latest and more interesting financial news, keep reading universo virtual Worth. Click here.