It’s a no-brainer that bank FDs have been one of the most popular investment options in our country since many decades. They are often the first port of call whenever most Indians think of putting aside some money to invest and at the same time keep it ‘safe’.

And all thanks to the five back-to-back repo rate hikes by the RBI in 2022, besides the lending rates, the interest rates on bank FDs have been rising continuously for the past few quarters. Both public sector banks as well as private sector banks, including small finance banks, have been raising their bank FD rates to attract investors to put their money into them.

The higher range of bank FDs at present is going as high as 7%-8.5%. Sounds lucrative, right?

shutterstock

But before you rush into the decision to lock in these high bank FD rates by investing right now, let us dig deeper and understand whether it actually makes sense to do so or not.

Jump To

![]()

What To Keep In Mind

Three primary parameters have to be kept in mind before locking your money into these lucrative FD rates. First is the post-tax return you get in hand, and second is the comparative returns of other investment instruments such as PPF, debt funds, equity funds amongst others. Third is the inflation rate and whether the post-tax FD returns beat it or not.

Taxation Of Bank FD Returns

Firstly, the tax liability of FD investors does not end with a TDS deduction done by banks. The entire interest income on your FD is added to your annual income and taxed as per the depositor’s tax slab, making the post-tax returns of bank FDs much lower, especially for those falling in the higher tax slabs. The difference between the actual tax liability and TDS amount deducted gets adjusted at the time of filing income tax returns.

shutterstock

Secondly, five-year tax-saver bank FDs, which offer the benefit of availing tax deductions up to Rs 1.5 lakh per financial year under Section 80C of Income tax act, too aren’t tax free. The interest earned on these will also be taxed according to your tax slab, which will reduce your post-tax returns.

Also Read: How Risky Is Investing In A Bank Fixed Deposit?

Calculation Of Post Tax Returns

Taking an example and using bank FD returns calculator can help you understand the post tax returns on your investment.

Suppose you booked a Rs 50,000 bank FD for a two-year tenure at 7% p.a. interest rate (compounded quarterly).

Now, the pre-tax returns calculate out to be a maturity amount of Rs 57,444. However, the post-tax returns come out to be a lower maturity amount of Rs 57,072 if you fall into the 5% income tax slab, Rs 56,700 if you fall into 10% tax slab, Rs 56,328 if you fall into 15% tax slab, Rs 55,956 if you fall into 20% tax slab and Rs 55,211 if you fall into 30% tax slab.

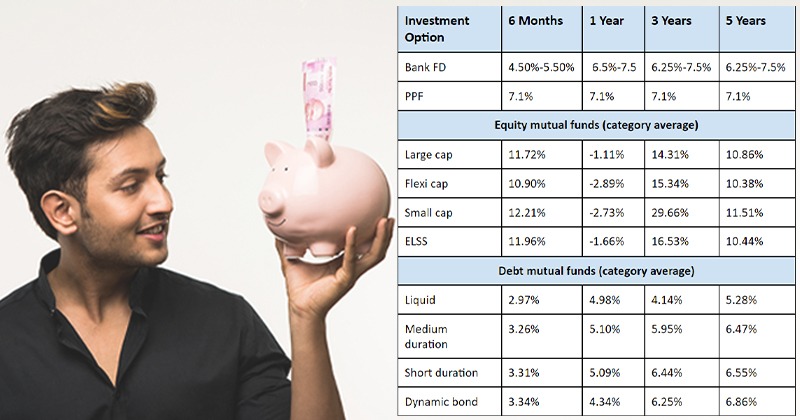

Comparison Of Returns

Let’s have a look at how current Bank FD returns fare against the like of PPF, debt and equity mutual funds:

PPF – 7.1% p.a. (reviewed by Finance Ministry in every quarter of a financial year)

Bank FD rates here are an indicative broad range currently offered by largest public and private sector banks, including small finance banks.)

For debt and equity mutual funds we have taken averages of some fund categories such as ELSS, small cap, large cap and flexi cap.

|

Investment Option |

6 Months |

1 Year |

3 Years |

5 Years |

|

Bank FD |

4.50%-5.50% |

6.5%-7.5 |

6.25%-7.5% |

6.25%-7.5 |

|

PPF |

7.1% |

7.1% |

7.1% |

7.1% |

|

Equity mutual funds (category average) |

||||

|

Large cap funds |

11.72 % |

-1.11 % |

14.31 % |

10.86 % |

|

Flexi cap funds |

10.90 % |

-2.89 % |

15.34 % |

10.38 % |

|

Small cap funds |

12.21 % |

-2.73 % |

29.66 % |

11.51 % |

|

ELSS |

11.96 % |

-1.66 % |

16.53 % |

10.44 % |

|

Debt mutual funds (category average) |

||||

|

Liquid funds |

2.97 % |

4.98 % |

4.14 % |

5.28 % |

|

Medium duration funds |

3.26 % |

5.10 % |

5.95 % |

6.47 % |

|

Short duration funds |

3.31 % |

5.09 % |

6.44 % |

6.55 % |

|

Dynamic bond funds |

3.34 % |

4.34 % |

6.25 % |

6.86 % |

Returns as on 13-Jan-2023, according to valueresearch.

Also Read: PPF vs ELSS vs Tax Saver Bank FD

Taxability Of Returns

As far as the taxability of returns is concerned, PPF’s returns are not taxable at all, as it falls into the EEE category (invested amount, interest earned and maturity value are all tax free). Taxation of mutual funds is done as – Short term gains (when investment is redeemed within 3 years) of debt mutual funds are taxed as per your income tax slab.

Whereas long term gains (when investment is redeemed after 3 years) on your debt fund units attract a tax rate of 20% after indexation. And for equity funds, 15% rate of tax is levied on short-term capital gains(when investment is redeem within 1 year), whereas long-term capital gains (when investment is redeemed after 1 year) get taxed at 10% (only for gains above Rs 1 lakh in a financial year).

Taxation rules for bank FDs have already been mentioned in this article.

shutterstock

You can check out taxation rules for various investment options here.

Does It Make Sense To Invest In FD Right Now?

Despite the capital protection and certainty of income being the twin key features of Bank FDs, it’s vital to weigh their pros and cons before zeroing in on any decision.

indiatimes

As the primary aim of investing your hard-earned money is wealth creation, remember that FD returns, despite the relatively high returns in present scenario, fall behind some investment options such as PPF and more so against equity mutual funds by a significant margin, especially the post tax returns.

Even in the above-mentioned table of comparative returns, it’s visible that although bank FD returns tend to currently outperform most debt funds’ categories for different tenures, they fall behind the rates of equity mutual funds in most tenures, and are more or less around the PPF’s rate of 7.1% for most tenures, barring the short tenure for 6 months.

It’s also important to factor in the upcoming interest rate scenario and the inflation rate. Given that RBI has already done five back-to-back repo rate hikes, the further scope of an upside is relatively narrower. As far as inflation is concerned, the Consumer Price Index (CPI)-based inflation rate relatively eased to 5.72% in December 2022. It was 5.88% in November, and 6.77% in October 2022. Bank FD rates at present hover around 4.5%-8.5% range.

shutterstock

Some banks which are offering the higher range of 8%-8.5% on bank FDs include these-Suryoday Small Finance Bank’s 8.01% for tenure of above 1 Year 6 Months to 2 Years and 8.51% for 999 days tenure), Ujjivan small finance bank offers 8.2% for a tenure of 80 weeks (560 Days) and Utkarsh small finance bank offers 8% for 700 days tenure,

Now if you are wondering if small finance banks are ‘safe’ to invest your FDs in? Well, the answer is yes. Click here to know more about this.

Remember that if you are fine with the post tax returns of bank FDs as per the current interest rates, you may go ahead and lock in these relatively higher interest rates by booking the FD. While doing so, try fetching 0.25-0.5% higher rates through senior citizen bank FDs if your parents or other elders through whom you can open bank FD.

Overall, if you can take some risk and can remain invested for medium to long term, it makes sense to choose equity mutual funds.. Equity as an asset class has a history of outperforming most of the other asset classes and fixed-income investment instruments, as well as inflation, by a wide margin in the long term, All you need to do is choose the appropriate equity mutual funds category (direct plan) as per your risk appetite, choose the suitable fund schemes and then remain patiently invested for long term to let the power of compounding work its magic and help you in wealth creation!

Also Read: How Much To Invest In Order To Become A Millionaire

For the latest and interesting financial news, keep reading universo virtual Worth. Click here.